If you have transferred money to another account, you must be familiar with the term “IFSC code” and have seen it on your bank passbook. Every bank provides its customers with a unique four-digit code known as the IFSC codes. HDFC, for example, has its own HDFC IFSC Code. However, do you know what is IFSC code and how it works?

What is the IFSC code?

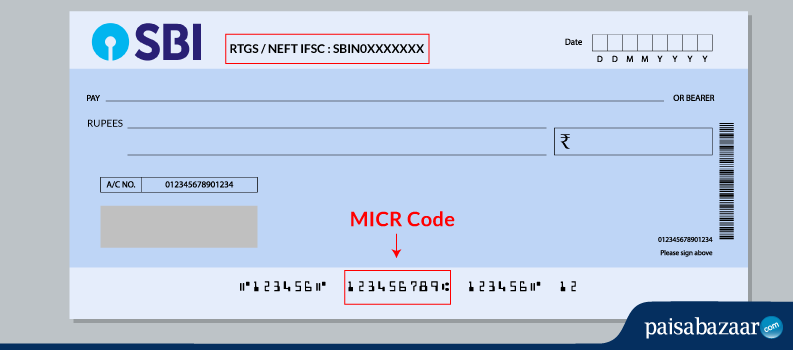

All payment methods, including NEFT, CFMS, and RTGS, to perform fund transfers require an IFSC code. To know what is IFSC Code, you will have to understand its full form and what it consists of. The Indian Financial System Code, abbreviated as IFSC, is an 11-digit alphanumeric code. You can use an IFSC code to identify each bank branch participating in the Reserve Bank of India’s NEFT network. The IFSC code is useful for transmitting money via RTGS, NEFT, or IMPS.

The IFSC code is broken into subparts of eleven digits. For example, the numbers for HDFC IFSC Code would be HDFC0001387. The first four alphabetic characters identify the SBI IFSC Code; the branch code is determined by the remaining six numeric or alphanumeric characters. Every IFSC code has the same fifth character, which is always zero.

Why is the IFSC Code important?

Once you know what is IFSC Code, you also need to understand what importance this 11-digit code has while transferring money. When doing a transaction, everyone wants to ensure that their funds get to the intended bank without any errors or faults. When funds are sent to the incorrect bank, it causes many issues and unnecessary inconvenience because one cannot reverse the transaction immediately.

IFSC facilitates electronic fund transfer transactions by sending or routing messages to specific bank branches. und transferring systems use IFSC to recognise both branches involved in a transfer procedure. Also, an IFS code is necessary to execute an online transaction to deposit funds into the correct account.

Do you know how to use an 11-digit bank IFSC code, such as HDFC IFSC Code, to transfer money? You can transfer money through three different methods: National Electronic Fund Transfer (NEFT), Immediate Payment Service (IMPS) and Real Time Gross Settlement (RTGS).

What are the benefits of an IFSC code?

Every IFSC code, whether it is an HDFC IFSC code or from other banks, offers the same benefits as the other. Some of the benefits of having an IFSC code are listed below.

- It facilitates financial transactions with great ease.

- It saves time as you do not have to stand in long queues to make a transaction.

- You can transfer money to account holders anywhere in the world.

- You can transfer money from the comfort of your home through net banking.

- There is an extra level of security while transferring money from one account to another. The IFSC code saves you from potential fraud and risks.

- You can access your net banking portal easily and at any time.

- With an IFSC codes, you may make travel payments and bill payments.

- You cannot initiate a fund transfer without an IFSC codes. It is also environmentally beneficial because everything is done online without needing paper.

Conclusion

Every bank has its own IFSC codes; for example, HDFC has its own HDFC IFSC code. The Reserve Bank of India, or RBI, is the central bank in charge of all fund transactions throughout the country. It creates and maintains the payment structure to ensure the security of every transaction. Net banking transactions run thanks to the IFS code smoothly.